sanford maine excise tax calculator

Select the year of your. The rates drop back on January 1st of each year.

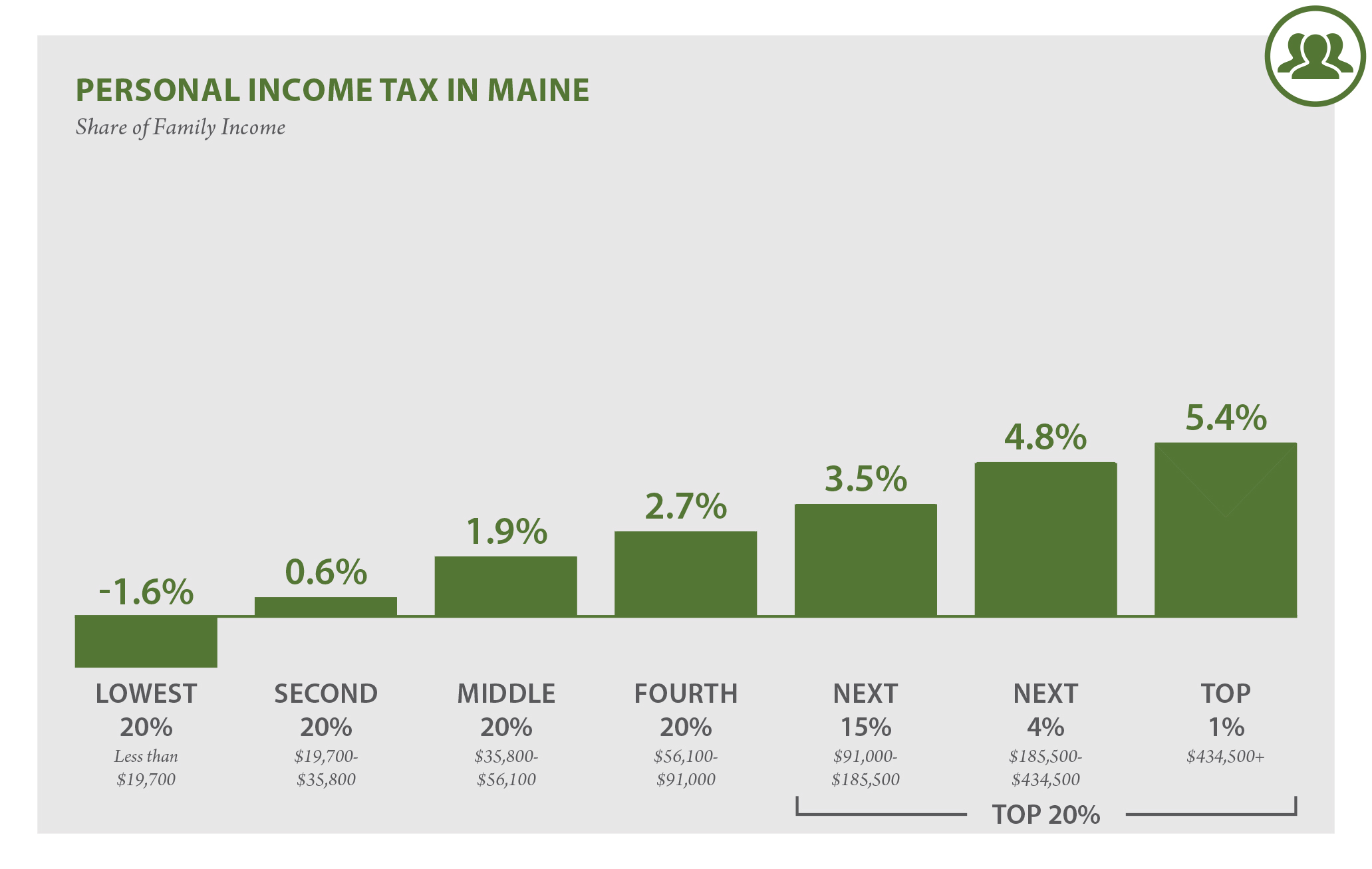

Maine Reaches Tax Fairness Milestone Itep

Under Used Cars select the make and model of your vehicle and click Go.

. Your vehicles MSRP The MSRP is the Manufacturers Suggested Retail Price of your vehicle. Assessor of Taxes - TOWN OF WARREN The state general sales tax rate of Maine is 55. The sales tax jurisdiction name is Maine which may refer to.

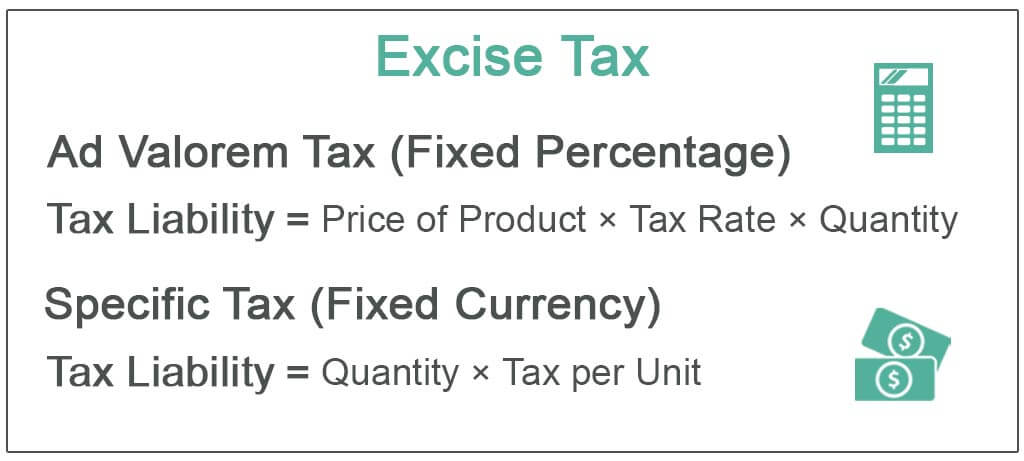

WHAT IS EXCISE TAX. Property Tax Stabilization Program. Maine Land for Sale.

How 2021 Sales taxes are calculated in Maine. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject. The rates drop back on January 1st of each year.

While many other states allow counties and other localities to collect a local option sales tax Maine does not. Boat excise tax must be paid by a resident to the tax collector of their town before registration. The excise tax you pay goes to the construction and.

Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. Town of Sanford is a locality in York County MaineWhile many other municipalities assess property taxes on a county basis Town of. Online calculators are available but those wanting to figure their excise tax in Maine can do so easily using a manual calculator or paper and pen.

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Collects excise taxes for motor vehicles and recreational vehicles as well as registering those items for. This calculator is for the renewal registrations of passenger.

Sanford Colorados Sales Tax Rate is 29. The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various Town expenses. A nonresident prior to registering a motorboat which is located in Maine more than 75 days.

The December 2020 total local sales tax rate was 5000. There is no applicable county tax city tax or special tax. Youll be taken to a page for all years of the particular vehicle.

Sales Tax Breakdown Sanford Details Sanford ME is in York. - NO COMMA For. Municipal Services and the Unorganized Territory.

Navigate to MSN Autos. Sanford maine excise tax calculator. Excise Tax is an annual tax that must be paid prior to registering a vehicle.

Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. The current total local sales tax rate in Sanford ME is 5500. Our office is also staffed to administer and oversee the property tax administration in the unorganized territory.

Enter your vehicle cost. The 55 sales tax rate in saco consists of 55 maine state sales tax. YEAR 1 0240 mill rate YEAR 2 0175 mill rate YEAR 3 0135.

To calculate your estimated registration renewal cost you will need the following information. Sanford collects the maximum legal local sales tax The 55 sales tax rate in Sanford consists of 55 Maine state sales tax. Where is the Town of Sanford Tax Assessors Office.

Please note this is only for estimation purposes -- the exact cost will be determined by the city when you register your vehicle. The Sanford Maine sales tax is 550 the same as the Maine state sales tax. The amounts shown are.

State has no general sales tax.

Tax Hikes Rare Among States So Far The Pew Charitable Trusts

How To Figure Your Excise Taxes In Maine Sapling

Maine 2022 Sales Tax Calculator Rate Lookup Tool Avalara

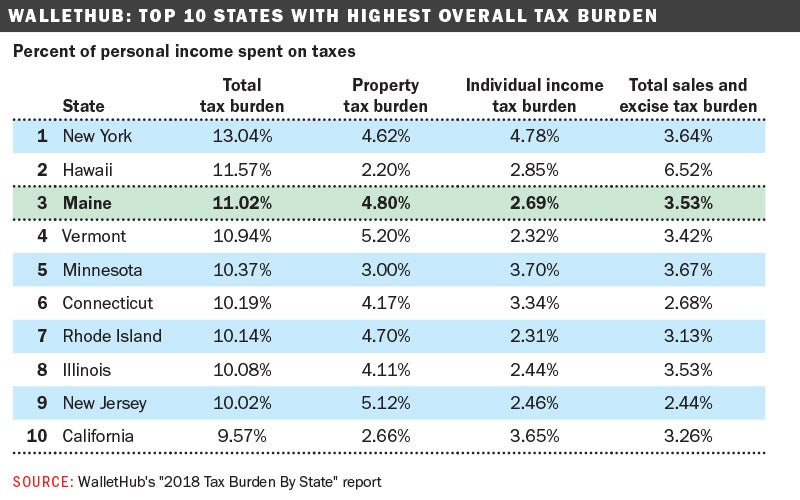

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

Maine Tax Conformity Bill A Step Toward Better Policy Tax Foundation

Maine Tobacco Vaping Tax Increase Proposal Tax Foundation

Maine Sales Tax Calculator And Local Rates 2021 Wise

Maine Sales Tax On Cars Everything You Need To Know

Ws July 3 2020 By Weekly Sentinel Issuu

What Is Excise Tax Small Business Owner Responsibilities

Clerk Tax Collection Topsham Maine

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Auto Excise Tax Repeal Question 2 2009 Ballotpedia

Excise Tax Definition Types Calculation Examples

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

Projects And Outcomes Of The Hm Ps 07 10

Maine Property Tax Calculator Smartasset

How To Calculate Cannabis Taxes At Your Dispensary

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute